Ecommerce Fraud Prevention & Payment Support Outsourcing Philippines: Safeguarding Revenue in the Age of Synthetic Identity

The 30-Second Executive Briefing

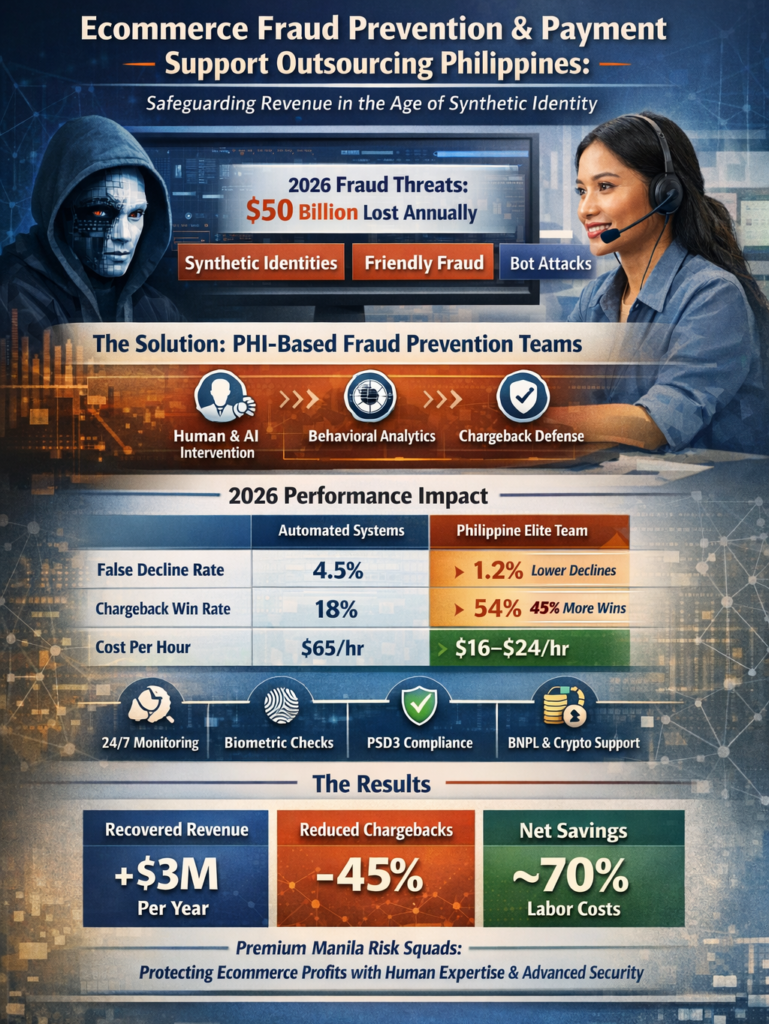

- The Problem: In 2026, AI-driven fraud has become a primary threat to e-commerce margins. From “Synthetic Identity” theft to advanced “Friendly Fraud” chargebacks, retailers are losing up to $50 billion annually to increasingly sophisticated digital attacks.

- The Shift: Fraud prevention has moved from reactive “Flag and Block” to Proactive Risk Orchestration.

- The Solution: Specialized ecommerce fraud prevention & payment support outsourcing Philippines that combines “Human-in-the-Loop” verification with real-time biometric and behavioral analytics.

- The Bottom Line: Premium Manila-based risk teams (US$16–$24/hr) reduce false declines by 32% and chargeback rates by 45%, ensuring that legitimate revenue flows while bad actors are blocked at the gate.

Executive Summary: Protecting the Lifeblood of the Business

Payment security is the foundation of consumer trust. Ecommerce fraud prevention & payment support outsourcing Philippines through trusted partners provides a 24/7 “Shield” for digital retailers. By leveraging the Philippines’ massive pool of finance and compliance professionals, brands can deploy dedicated risk squads that understand the nuances of global payment gateways and emerging fraud patterns, turning security from a friction point into a competitive advantage.

The 2026 Fraud Landscape: Beyond Stolen Credit Cards

In 2026, fraud is no longer just about stolen numbers; it’s about account takeovers (ATO) and automated bot-driven checkout abuse.

Why Automated Systems Alone Fail:

- The False-Decline Crisis: Over-aggressive AI filters often block legitimate high-value customers, resulting in a $443 billion loss in potential sales globally.

- Friendly Fraud Sophistication: Customers increasingly use “Chargeback Gaming” (claiming items never arrived), requiring manual evidence collection that domestic teams rarely have time to manage.

- Regulation Complexity: Managing payments across the US, UK, and EU requires constant compliance with evolving PSD3 (2026 version) and diverse local payment regulations.

Unit Economics: The “Margin Protection” ROI

In 2026, the ROI of a Philippine fraud team is measured by “Recovered Revenue” and “Lowered Loss Ratios.”

Table 1: 2026 Fraud & Payment Performance Matrix

| Metric | Automated System Only | Philippine Elite (Hybrid) | Business Impact |

| False Decline Rate | 4.5% | 1.2% | $3M+ Recovered/Year |

| Chargeback Win Rate | 18% | 54% | Reduced Loss-to-Sales |

| Review Turnaround | 12–24 Hours | <15 Minutes | Faster Shipping |

| Fully Burdened Rate | US$55 – $85 / hr | $16 – $24 / hr | ~70% Net Savings |

The “Intelligent Sentry” Model: Philippines 2026

Elite Manila risk teams utilize Agentic Risk Frameworks to outmaneuver modern fraudsters:

- Behavioral Biometric Triage: As a user checks out, the AI monitors “Keystroke Dynamics” and mouse movements. If a mismatch is detected, the Manila specialist is alerted to perform a real-time manual review before the order is processed.

- Chargeback Evidence Automation: When a dispute is filed, Philippine specialists use AI to instantly pull delivery photos, GPS logs, and communication history, submitting a “Bulletproof” evidence package to the bank within hours.

- Alternative Payment Support: Experts manage the complexities of “Buy Now, Pay Later” (BNPL), Crypto-wallets, and Central Bank Digital Currencies (CBDCs), resolving payment failures that would otherwise result in abandoned carts.

The Expert Perspective: The Dual-Lens Defense

John Maczynski, CEO of PITON-Global, notes: “In 2026, e-commerce security is a battle of human intelligence versus adversarial AI. Having managed global BPO operations and scaled high-growth e-commerce ventures, I’ve seen that ‘set it and forget it’ fraud tools have become a liability; they either let sophisticated bots in or lock genuine customers out. The competitive advantage of the Philippine workforce lies in their analytical rigor and ‘Human-in-the-Loop’ oversight. Data from our BPO partners shows that Manila-based specialists can spot the subtle behavioral anomalies that even the most advanced algorithms miss. When you move your risk and payment support to a premium Philippine team, you aren’t just cutting costs—you’re deploying a dedicated cognitive defense force that protects your bottom line as if it were their own.”

Security, Compliance, and Data Sovereignty

Managing payments requires the highest level of trust. Premium Philippine hubs lead with “Bank-Grade” Governance:

- PCI-DSS Level 1 Environments: Clean-room operations where agents have no access to recording devices, pens, or paper.

- GDPR/CCPA Orchestration: Ensuring every payment interaction is compliant with the strictest global data privacy laws.

- VDI-Only Access: Risk specialists work within “Stateless” virtual environments, ensuring sensitive financial data never physically resides in the Philippines.

Fraud Data as a “Whitelisting” Asset

A unique 2026 insight: Good fraud prevention identifies your best customers. Philippine teams use “Identity Resolution” tools to identify high-trust, repeat buyers. By “Whitelisting” these customers, the brand can offer “One-Click” checkout and bypass traditional security friction, significantly increasing long-term LTV (Lifetime Value).

Expert FAQ: The Fraud & Payment Briefing

Q: Can they handle 24/7 monitoring?

Yes. The Philippines’ 24/7 BPO infrastructure is ideal for “Always-On” monitoring, catching fraud in the US or UK while domestic teams are offline.

Q: How do they handle “Social Engineering” attacks?

Philippine specialists undergo “Adversarial Training” to identify phishing and “Vishing” attempts aimed at customer support agents.

Q: Can they integrate with our current stack (e.g., Forter, Signifyd, Stripe)?

Absolutely. Most premium Manila teams are certified in the leading 2026 risk platforms and integrate via secure API or middleware.

PITON-Global connects you with industry-leading outsourcing providers to enhance customer experience, lower costs, and drive business success.

Ralf Ellspermann is a multi-awarded outsourcing executive with 25+ years of call center and BPO leadership in the Philippines, helping 500+ high-growth and mid-market companies scale call center and customer experience operations across financial services, fintech, insurance, healthcare, technology, travel, utilities, and social media.

A globally recognized industry authority—and a contributor to The Times of India and CustomerThink —he advises organizations on building compliant, high-performance offshore contact center operations that deliver measurable cost savings and sustained competitive advantage.

Known for his execution-first approach, Ralf bridges strategy and operations to turn call center and business process outsourcing into a true growth engine. His work consistently drives faster market entry, lower risk, and long-term operational resilience for global brands.