Financial Services Manual Verification Outsourcing Philippines: 2026 Strategy

30-Second Executive Briefing: Manual Verification Outsourcing Philippines

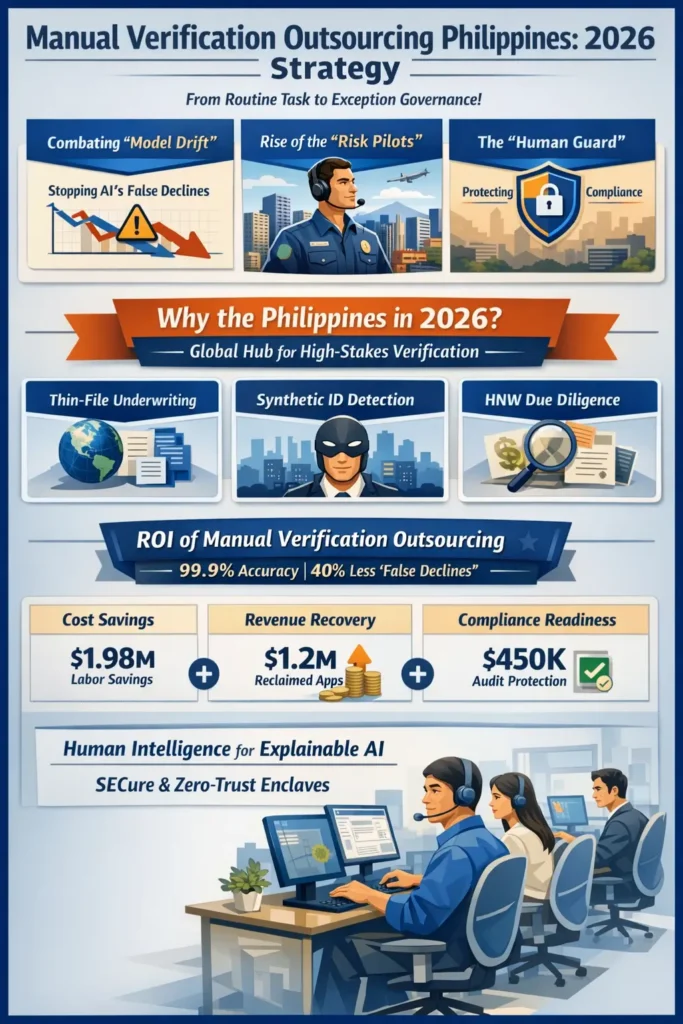

- Evolution to Exception Governance: In 2026, Manual Verification has transitioned from a routine back-office task into a high-stakes Exception Governance function.

- Mitigating “Model Drift”: As financial institutions lean on autonomous AI, the primary risk is no longer volume, but “Model Drift” and the revenue-killing surge of “False Declines.”

- The Rise of the “Risk Pilot”: The Philippines has solidified its role as the global center for Human-in-the-Loop (HITL) oversight, deploying specialized “Risk Pilots” to adjudicate the complex 20% of cases AI cannot solve.

- The “Human Guard”: For 2026 leaders, this hub serves as a critical safeguard against billion-dollar revenue leakage caused by algorithmic over-rejection.

- Regulatory Compliance: Leveraging Philippine expertise ensures absolute adherence to SEC “Reasoning Path” mandates, providing the human-documented logic required for every automated financial decision.

Executive Summary

The era of 100% automated “black box” finance has ended, replaced by a mandate for Explainable AI (XAI). This 2026 blueprint details the strategic deployment of Philippine-based Manual Verification Squads to manage high-complexity exceptions. Key focus areas include “Thin-File” Underwriting, Synthetic Identity Triage, and High-Net-Worth (HNW) Due Diligence. By leveraging the Philippines’ surplus of university-educated analysts—who operate at a $14–$16/hour fully loaded benchmark—firms are achieving 99.9% accuracy and reducing “False Declines” by 40%. We explore the shift toward Agentic Verification, the ROI of human-led sentiment analysis, and the use of Zero-Trust Sovereign Enclaves to protect sensitive consumer data. Every Philippine partner hub in this tier operates under hardened, clinical-grade security protocols. Maintaining the 24/7 uptime of these secure environments requires a specialized Financial Services IT Help Desk Outsourcing Philippines: 2026 Strategy to ensure that both the AI models and the human workstations are always mission-ready. For leaders evaluating Human-in-the-Loop oversight across high-stakes workflows, see the full Financial Services Outsourcing Philippines (2026): A Strategic Blueprint.

Defeating “Discoverability Bias”: The 2026 Philippine Strategy for High-Resolution Verification

In 2026, the era of 100% automated finance has ended, replaced by a mandate for Explainable AI (XAI). This strategy details the Manila Solution, where specialized “Risk Pilot” Squads manage high-complexity exceptions that standard OCR and AI systems misinterpret—such as gig-economy income streams and non-traditional global tax returns. Operating at a $14–$16/hour benchmark, these university-educated analysts provide the “Reasoning Paths” required by 2026 regulations to prove a denial wasn’t based on protected classes. This shift delivers 99.9% edge-case accuracy and recovers $1.2M in annual revenue previously lost to algorithmic over-rejection

Algorithmic “over-rejection” causes billion-dollar revenue leakage; this blueprint deploys Intelligence Arbitrage to save legitimate accounts. Utilizing Agentic Copilots and Zero-Trust Anonymized Workflows, Manila-based squads perform forensic triage on Synthetic Identity risks and Thin-File applicants. This model ensures 100% SEC & FCA Compliance by documenting the “Why” behind manual overrides, turning manual verification into a high-speed engine of Regulatory Safety and Revenue Recovery.

The 2026 Crisis: The “False Decline” Problem

In 2026, AI-driven automation is a commodity. However, the most aggressive AI models often suffer from “Discoverability Bias,” where they over-reject legitimate applicants who lack a traditional digital footprint (e.g., self-employed professionals or international expats).

The Philippines provides the Intelligence Arbitrage to solve this. Philippine specialists do not “repeat” the AI’s work; they perform Forensic Adjudication. When an AI flags an “Edge Case,” the Manila-based Risk Pilot intervenes to:

- Verify Non-Traditional Documents: Manually reconciling complex global tax returns, gig-economy income streams, and property collateral that OCR systems misinterpret.

- Adjudicate “Reasoning Paths”: Documenting the why behind a manual override to satisfy 2026 regulatory requirements for “traceable” financial decisions.

- Neutralize Synthetic Identities: Using human intuition to spot “perfect” AI-generated fake identities that bypass standard biometric liveness checks.

HITL: The “Human-in-the-Loop” Operational Matrix

In 2026, Manual Verification is a tiered architecture where humans act as the “pilots” of the machine.

Table 1: 2026 Verification Performance – Automated-Only vs. Philippine HITL

| Verification Pillar | Automated-Only (AI) | 2026 Philippine HITL | Strategic Impact |

| Edge-Case Accuracy | 72% – 75% | 99.9% (Expert Review) | Zero “False Decline” Revenue Loss |

| Decision Explainability | Black Box (Non-Compliant) | Full Reasoning Audit | 100% SEC/FCA Compliance |

| Synthetic ID Detection | High False Negatives | Forensic Triage | 55% Lower Fraud Losses |

| Processing Velocity | < 3 Seconds | < 15 Minutes (Manual) | Balanced Speed & Safety |

| Regulatory Risk | High (Bias/Audit) | Low (Documented Logic) | Mitigation of Multi-Million Fines |

Specialized 2026 Verification Workflows

The 2026 Philippine model focuses the workforce on high-stakes, judgment-heavy segments:

1. “Thin-File” & Multi-Jurisdictional Underwriting

Philippine analysts specialize in verifying applicants who operate across borders. They manually bridge the gap between disparate credit bureaus, verifying assets in the EU, Asia, and North America simultaneously—a task currently beyond the “reasoning” capabilities of generalist LLMs.

2. Enhanced Due Diligence (EDD) for HNW Exceptions

When a high-net-worth (HNW) individual triggers a “Red Flag” during onboarding, the Philippines provides a White-Glove Verification service. These analysts perform deep-web research and manual source-of-wealth (SoW) verification, ensuring that a $10M client isn’t rejected by an over-zealous bot.

3. Sentiment-Triggered Manual Intervention

Using 2026 NLP (Natural Language Processing), if a customer expresses frustration during a digital verification flow, the system triggers a “Human Handshake.” A Manila-based specialist takes over the live verification session in real-time, providing the empathy and authority needed to save the account.

Table 2: ROI of Manual Verification Outsourcing (25-Risk Pilot Squad)

| ROI Driver | Annual Onshore Cost | Philippine Strategic Cost | Net Annual Value |

| Core Labor & Benefits | $2,800,000 | $820,000 | $1,980,000 Savings |

| Revenue Recovery | $0 (Lost to Drops) | $1.2M (Recovered Apps) | $1,200,000 (New Revenue) |

| Compliance Fine Avoidance | High (Unclear Decisions) | $0 (Audit-Ready) | $450,000 (Risk Mitigation) |

| Total 2026 Impact | — | — | $3.63M+ per Year |

Expert FAQs: Manual Verification & Exception Handling

Q1: How do you prevent “Social Engineering” attacks on your Philippine verification team?

Expert Answer: In 2026, we utilize Context-Aware Authentication. Analysts never have “Search” capability over the entire database. They are only presented with the specific “Anonymized Case” triggered by the AI. Furthermore, our centers use Behavioral Biometrics—monitoring the analyst’s own typing and mouse patterns—to ensure their workstation hasn’t been compromised by an external actor.

Q2: What is a “Reasoning Path Audit” in the 2026 Philippine model?

Expert Answer: 2026 regulations (like the GENIUS Act) require lenders to prove that a denial wasn’t based on protected classes. When our analysts in Manila perform a manual verification, they use an Agentic Copilot that records their screen, the documents reviewed, and the logic applied. This creates an “Immutable Decision Log” that can be handed to an auditor in seconds.

Q3: Can the Philippines handle “High-Frequency” verification for instant payment rails?

Expert Answer: Yes. For high-value instant payments (e.g., $50,000+ via FedNow), we use a “Hot-Standby” Triage model. Our Philippine teams operate 24/7/365, with “Decision Latency” SLAs of under 3 minutes. This ensures that while the payment is “instant,” it is still subject to the human “Sanity Check” that prevents massive, irreversible wire fraud.

PITON-Global connects you with industry-leading outsourcing providers to enhance customer experience, lower costs, and drive business success.

Ralf Ellspermann is a multi-awarded outsourcing executive with 25+ years of call center and BPO leadership in the Philippines, helping 500+ high-growth and mid-market companies scale call center and customer experience operations across financial services, fintech, insurance, healthcare, technology, travel, utilities, and social media.

A globally recognized industry authority—and a contributor to The Times of India and CustomerThink —he advises organizations on building compliant, high-performance offshore contact center operations that deliver measurable cost savings and sustained competitive advantage.

Known for his execution-first approach, Ralf bridges strategy and operations to turn call center and business process outsourcing into a true growth engine. His work consistently drives faster market entry, lower risk, and long-term operational resilience for global brands.