Payment Operations Outsourcing Philippines: 2026 Strategic Blueprint

30-Second Executive Briefing: Payment Operations Outsourcing Philippines

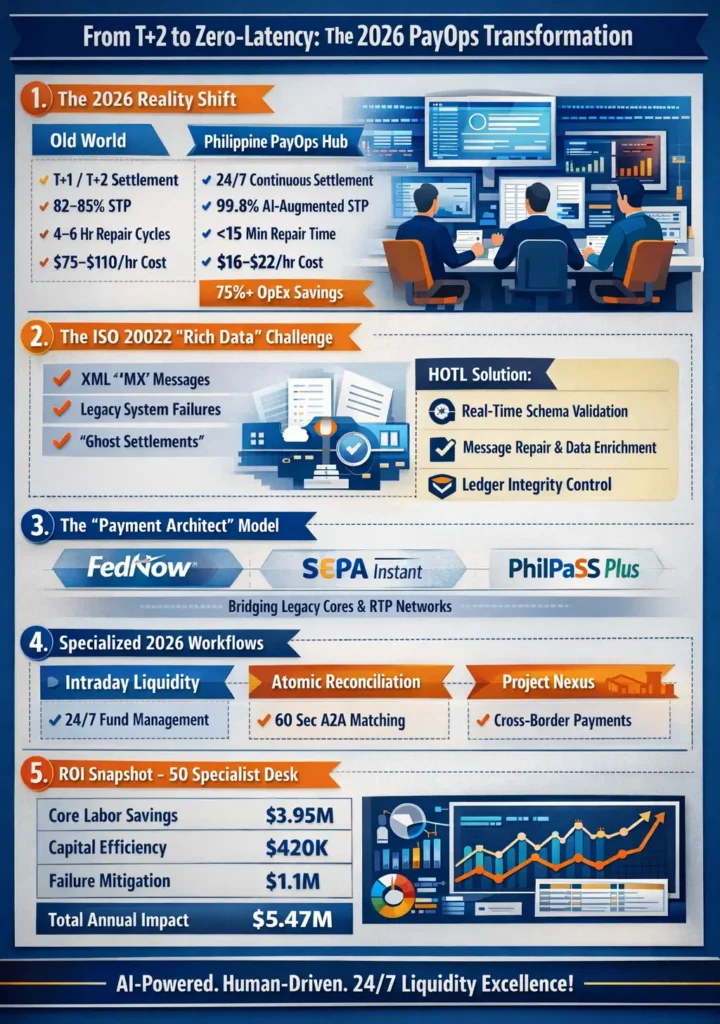

- Real-Time Governance Shift: In 2026, PayOps has evolved from a reactive back-office task into a proactive, real-time mission-critical requirement for financial institutions.

- The Death of T+2: The traditional “T+2” settlement cycle is obsolete, replaced by Continuous Settlement and the mandatory global adoption of ISO 20022 “rich data” standards.

- Strategic Hub Status: The Philippines has emerged as the premier global hub, providing “Payment Architects” who specialize in bridging the gap between legacy core banking and Instant Payment (RTP) networks.

- Beyond Labor Arbitrage: Outsourcing to Manila is now a strategic play for Operational Velocity, ensuring 24/7 liquidity management with 99.9% settlement finality and zero data truncation.

- Regulatory Resilience: Leveraging Philippine expertise allows firms to navigate high-stakes migrations and real-time transparency requirements enforced by 2026 global regulators.

Executive Summary

The 2026 global payment ecosystem is defined by “Rich Data” and “Zero-Latency Settlement.” With regulators now mandating sub-second transparency, financial institutions face a widening gap between legacy core banking systems and modern payment rails. This blueprint outlines the strategic integration of Philippine-based PayOps hubs to manage High-Value Payment Systems (HVPS). Key focus areas include ISO 20022 Message Repair, Intraday Liquidity Orchestration, and Atomic Reconciliation. By leveraging the Philippines’ mature financial ecosystem, firms are reducing payment failure rates by up to 70% and transforming PayOps from a defensive cost center into a strategic liquidity asset. To understand how ISO 20022 migration and real-time settlement fit into a broader transformation agenda, explore the full Financial Services Outsourcing Philippines 2026 blueprint.

Mastering the ISO 20022 Migration: The 2026 Philippine Strategy for Payment Velocity

By 2026, the global transition to ISO 20022 is mandatory, but the operational burden of managing “MX” messages—which carry 10x more data than legacy formats—has spiked. This strategy details the Manila Solution, where specialized “Payment Architects” perform real-time Message Repair and XML Schema Validation to prevent stalled settlements. Operating at a $14–$16/hour benchmark, these hubs provide 24/7/365 oversight for Intraday Liquidity Orchestration, ensuring every wallet is funded and every rail (from FedNow to SEPA) is active. This shift delivers over 60% operational savings while maintaining a 99.9% settlement finality rate.

Legacy systems fail the 2026 “MX” data requirements, leading to rejected messages and “Data Truncation”. The Philippine Strategic Blueprint deploys ISO-Native teams to act as a Technical Translation Layer, enriching legacy data to meet modern global standards. By integrating Agentic AI with human “Sanity Checks,” Manila hubs verify the intent of AI-initiated payments to prevent “rogue” transactions. This model ensures SEC-mandated 36-hour incident disclosure and PCI-DSS 4.0 compliance, turning payment operations into a high-speed engine of Global Settlement Excellence.

The 2026 Shift: ISO 20022 and the “Data Truncation” Crisis

By 2026, the global transition to ISO 20022 is complete, but the operational burden has spiked. Unlike legacy SWIFT MT messages, ISO 20022 “MX” messages carry massive amounts of structured data. When this “rich data” hits a legacy core system that isn’t fully compatible, it triggers a “Hard Decline” or, worse, a silent failure.

The Philippines provides the Human-on-the-Loop (HOTL) safety valve for these digital bottlenecks. Philippine PayOps specialists act as Data Translation Layers, utilizing AI-augmented tools to:

- Validate XML Schemas: Ensuring every outbound payment meets the specific clearinghouse requirements of the destination country.

- Execute Message Repair: Manually intervening to populate missing mandatory fields (like Purpose Codes or Ultimate Debtor Info) that automated systems often miss.

- Prevent “Ghost Settlements”: Resolving instances where money is moved but the accompanying data is lost, ensuring the ledger remains the “Source of Truth.”

Intelligence Arbitrage: The “Payment Architect” Model

In 2026, the Philippines is no longer just a BPO destination; it is an Intelligence Hub. The workforce consists of “Payment Architects”—professionals who understand the interplay between FedNow, SEPA Instant, and the Philippines’ own PhilPaSS Plus system.

Table 1: 2026 Payment Ops Benchmarks – Onshore vs. Philippine Hub

| Performance Metric | Legacy Onshore (US/UK) | 2026 Philippine PayOps | Strategic Impact |

| Settlement Latency | T+1 to T+2 (Batch) | Near Real-Time (24/7) | Maximize Working Capital |

| STP (Straight-Through Processing) | 82% – 85% | 99.8% (AI-Augmented) | Drastic Reduction in Rework |

| Payment Repair Velocity | 4 – 6 Hours | < 15 Minutes | Eliminates Operational “Drag” |

| Compliance Accuracy | 97.4% | 99.9% (Continuous Audit) | Zero “Technical Failure” Fines |

| Fully Loaded Cost (p/hr) | $75 – $110 | $16 – $22 | 75%+ OpEx Savings |

Specialized 2026 Operational Workflows

Beyond simple wire transfers, the 2026 Philippine PayOps model covers the most complex “New Rail” challenges:

1. Intraday Liquidity Orchestration

In a 24/7 payment world, banks can no longer wait for the morning “funding run.” Philippine teams manage Liquidity Buffers in real-time, moving funds between Nostro/Vostro accounts to ensure that instant payment rails are never starved of liquidity during late-night US/EU hours.

2. Atomic Reconciliation for A2A Rails

As Account-to-Account (A2A) payments replace traditional card transactions for high-value B2B trade, the reconciliation volume has tripled. Philippine specialists perform Atomic Reconciliation, matching incoming transaction signals against internal ledgers at the line-item level every 60 seconds to prevent “Double Spending” or ledger drift. This granular data stream is then funneled into a specialized Financial Services Data Analytics & Management Outsourcing Philippines: 2026 Strategic Blueprint, where raw telemetry is transformed into predictive insights for the C-suite.

3. Cross-Border “Project Nexus” Integration

As the Philippines integrates into Project Nexus (the BIS-led project to connect instant payment systems globally), Manila hubs serve as the primary gateway for cross-border retail payments, managing the currency FX conversion and regulatory reporting in one seamless workflow.

Table 2: ROI of Specialized PayOps Outsourcing (50-Specialist Desk)

| ROI Driver | Annual Onshore Cost (est.) | Philippine Strategic Cost | Net Annual Value |

| Core Labor & Benefits | $5,500,000 | $1,550,000 | $3,950,000 Savings |

| Capital Efficiency Gain | Static/Trapped Liquidity | Dynamic Optimization | $420,000 (Interest Yield) |

| Failure Mitigation (Fines) | High Risk of Late-Settle | Continuous Compliance | $1,100,000 (Loss Avoidance) |

| Total 2026 Impact | — | — | $5.47M per Year |

Expert FAQs: Payment Operations & Settlement

Q1: How does the Philippines handle the “Material Incident” reporting mandated by 2026 SEC Cyber Resilience rules?

Expert Answer: Under the 2026 frameworks, firms must disclose a payment-disrupting cyber incident within 36 hours. Elite Philippine hubs operate Zero-Trust Security Operations Centers (SOCs) that are integrated directly with the PayOps desk. This allows for a “Unified Response”: if a payment rail is compromised, the Philippine team can enact a “Kill Switch” and generate the necessary regulatory disclosure logs simultaneously, ensuring you meet the 36-hour window with verified data.

Q2: What is the role of the ISO 20022 “Harmonization Team” in Manila?

Expert Answer: The BSP (Bangko Sentral ng Pilipinas) has mandated ISO 20022 across all retail payments by 2026. This has created a surplus of talent in Manila that is “ISO-Native.” These teams specialize in “Mapping & Translation”—taking old-format data from your legacy core banking system and “enriching” it to meet the strict 2026 global standards, preventing your institution from being “blacklisted” by modern receiving banks.

Q3: Can Philippine PayOps teams manage “Agentic Commerce” payments? Expert Answer: Yes. In 2026, AI agents now initiate over 12% of B2B transactions. Philippine hubs serve as the “Intent Verification Layer.” When an AI agent initiates a high-value payment, the Manila-based specialist performs a secondary “Sanity Check” against behavioral data and pre-set corporate limits to ensure the AI hasn’t “gone rogue” or been compromised by a prompt-injection attack.

PITON-Global connects you with industry-leading outsourcing providers to enhance customer experience, lower costs, and drive business success.

Ralf Ellspermann is a multi-awarded outsourcing executive with 25+ years of call center and BPO leadership in the Philippines, helping 500+ high-growth and mid-market companies scale call center and customer experience operations across financial services, fintech, insurance, healthcare, technology, travel, utilities, and social media.

A globally recognized industry authority—and a contributor to The Times of India and CustomerThink —he advises organizations on building compliant, high-performance offshore contact center operations that deliver measurable cost savings and sustained competitive advantage.

Known for his execution-first approach, Ralf bridges strategy and operations to turn call center and business process outsourcing into a true growth engine. His work consistently drives faster market entry, lower risk, and long-term operational resilience for global brands.